The Principal Chief Commissioner of Income-Tax (Pr.CCIT), Mumbai Region released an online notice to appoint 97 posts of Stenographer Grade-II, Tax Assistant and Multi-Tasking Staff. These vacancies are only for sportspersons. Applicants who age between 18 to 27 years can apply Mumbai Income Tax Sports Quota Recruitment 2026 on the official website of mumbai income tax.

Online applications for the Mumbai Income Tax Recruitment 2026 will be accepted from January 7 to January 31, 2026. Candidates who are shortlisted after completing all stages of the selection process will be appointed under the Pay Level as per the 7th Central Pay Commission (CPC) Pay Matrix.

Income Tax Sports Quota Recruitment 2026

Income Tax Department of Mumbai region is going to recuit 47 Tax Assistants, 38 Multi Tasking Staff and 12 Grade II Stenographers. For this recruitment, department has released an official notification which include selection process, application procedure, application fee and game/sports liston the official website.

Vacany Details As Per Sports/Games

| Sport Discipline | Number of Vacancies |

|---|---|

| Athletics | 26 |

| Swimming | 6 |

| Badminton | 4 |

| Table Tennis | 4 |

| Chess | 4 |

| Lawn Tennis | 4 |

| Cricket | 10 |

| Basketball | 4 |

| Volleyball | 5 |

| Kabaddi | 7 |

| Football | 11 |

| Billiards | 2 |

| Squash | 2 |

| Yogasan | 2 |

| Para Sports | 4 |

| Boxing | 2 |

Age Limits

- Stenographer Grade-II (Steno): 18 to 27 years (as on 01.01.2026)

- Tax Assistant (TA): 18 to 27 years (as on 01.01.2026)

- Multi-Tasking Staff (MTS): 18 to 25 years (as on 01.01.2026)

Educational Eligibility

- Stenographer Grade II (Steno): 12th Class pass or equivalent from a recognized Board or University

- Tax Assistant (TA): Bachelor’s degree from a recognized University or an equivalent qualification

- Multi-Tasking Staff (MTS): Matriculation or equivalent pass

Salary Details

- Stenographer Grade-II (Steno): Pay Level 4 (₹25,500 – ₹81,100)

- Tax Assistant (TA): Pay Level 4 (₹25,500 – ₹81,100)

- Multi-Tasking Staff (MTS): Pay Level 1 (₹18,000 – ₹56,900)

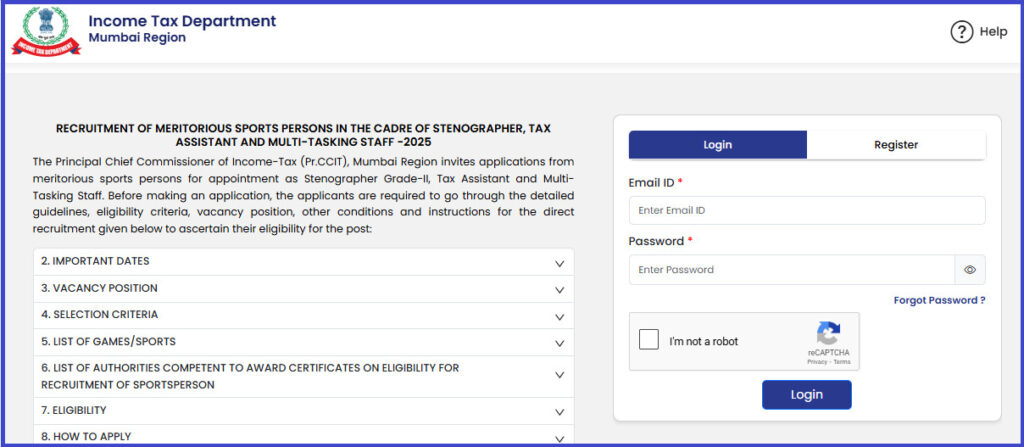

How to apply Income Tax Recruitment 2026?

Step 1:

Candidates must carefully read the official notification, eligibility conditions, instructions, and vacancy details before proceeding with the application.

Step 2:

Eligible and interested applicants are required to submit their application online only from the date of publication of the advertisement up to the closing date. The online application form is available on the official website: https://www.incometaxmumbai.gov.in.

Step 3:

All required and supporting documents must be uploaded along with the online application form.

Step 4:

A candidate may apply for multiple posts and/or sports disciplines through one single application form only. Submission of more than one application will lead to rejection of all applications without any consideration.

Step 5:

Applicants must clearly mention their order of preference for the posts applied for (first preference, second preference, and so on) in the application form.

Step 6:

If the post preference is not indicated in the column “Post Applied For,” the application will be rejected without further communication.

Step 7:

Candidates claiming age or category relaxation must ensure they meet the eligibility criteria and upload valid supporting documents as prescribed in the notification.

Step 8:

Applicants belonging to SC/ST categories must upload a valid caste certificate issued by the competent authority, in the prescribed Government of India format.

Step 9:

Sports achievement certificates must be issued by the competent authorities and strictly follow the formats prescribed under Annexure-A of DoPT OM No. DOPT-1720781414772 dated 04.03.2024. Certificates issued in any other format or by unauthorized authorities will not be considered.

Step 10:

Sportspersons currently employed in Central/State Government departments, organizations, or PSUs must upload a No Objection Certificate (NOC) from their present employer.

Step 11:

Applicants must upload self-attested copies of the following documents, as applicable:

- Proof of date of birth (Matriculation/SSC certificate, Birth Certificate, Aadhaar Card, or Passport)

- Educational qualification certificates

- Caste/Community certificate (if applicable)

- Sports/Games achievement certificates

- Eligibility certificates for recruitment of sportspersons (Forms 1, 2, 3, 4, or 5, as applicable)

- PwBD certificate and UDID card (if applicable)

- NOC from the current employer (if applicable)

- Aadhaar Card

- Recent passport-size photograph

Step 12:

All updates and communications related to the recruitment process will be sent to the candidate’s registered email ID mentioned in the application form.

Step 13:

Applications submitted in offline mode, or online applications with invalid, incomplete, or illegible documents, will be rejected outright. No correspondence will be entertained in such cases.

Instructions For Applicants

- Non-compliance with the notified instructions or conditions will lead to rejection of the application without any notice, and no correspondence will be accepted.

- In case of a tie or any related matter, the decision of the Pr. CCIT, Mumbai shall be final and binding.

- For any queries or clarifications related to application submission, candidates may contact [email protected].

- Any attempt to canvass in any form will result in immediate disqualification at any stage of the recruitment process.

- The Pr. CCIT, Mumbai reserves the right to cancel the recruitment at any stage without assigning any reason.

- Applicants should regularly visit www.incometaxmumbai.gov.in for updates and further information.

- In case of any inconsistency in the advertisement text, the English version shall prevail over other language versions

FAQs

What is the last date to apply for Income Tax Sports Quota Recruitment 2026?

January 31, 2026.

Which posts are available under Mumbai Income Tax Recruitment 2026?

A total of 97 vacancies are available across:

Stenographer Grade-II

Tax Assistant (TA)

Multi-Tasking Staff (MTS)

What are the important dates for Income Tax Recruitment 2026?

Notification Released: 7 January 2026

Online Application Start: 7 January 2026

Last Date to Apply Online: 31 January 2026